Property prices are rebounding, according to Trade Me’s September Property Price Index.

After five months of back-to-back declines, the national average asking price for a property in September was $823,550, up 0.6% from August – the first time since March prices have seen a month-on-month increase.

Auckland, which saw house prices drop below the one-million-dollar mark in August for the first time in four years, bounced back from $986,750 to $996,350 in September.

And let’s not forget that Trade Me’s September figures pre-date the Reserve Bank’s decision earlier this month to cut the benchmark cash rate by 50 basis points to 4.75%, its lowest level in 18 months of cutting. The move triggered a spate of lower home loan interest rates and further predictions about the likelihood of future cuts.

The suggestion that lower bank interest rates could stimulate demand for housing and, in turn boost asking prices, isn’t unreasonable.

In an interesting regional variation, Auckland showed strong growth in average asking prices for larger homes – up 7.2%. On the other hand, in Wellington, prices were down 17.5% for properties of the same size.

Average asking price

National values turn corner in September, Auckland not so much

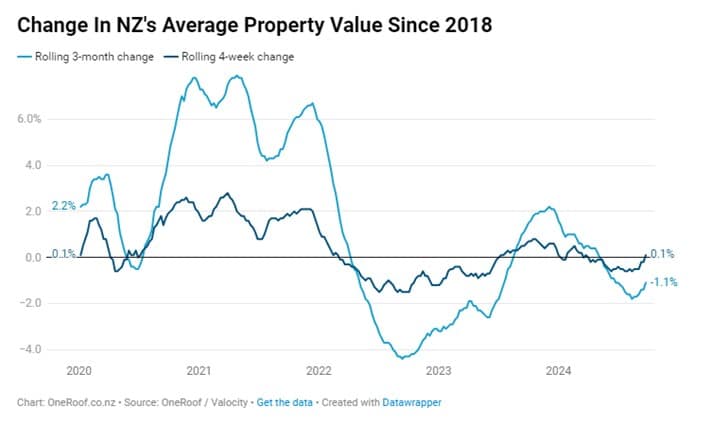

The nationwide average property value hit $957,000 at the end of September, down 1.1% on the $968,000 recorded at the end of June, according to the OneRoof-Valocity House Value Index.

However, in the four weeks to the end of September, the nationwide average property value recorded its first gain since the first quarter.

The picture isn’t as rosy in Auckland.

The city of sail’s average property value dropped 1.1% to $1.276 million in the three months to the end of September – down 2.4% year-on-year. However, the rate of decline slowed from 3% at the end of July, and weekly figures showed a slight increase in September.

Return to healthy market conditions slowed by broader economic malaise

Lower interest rates make mortgage holders happy. But whether that translates to meaningful changes in the housing market remains to be seen.

A host of other challenges could stifle progress, including GDP (down 0.2% for the June quarter), unemployment (forecast to rise to 5% by 2025), and declines in net migration (more Kiwis left to live permanently overseas in October than in any month since January 2009, according to Statistics New Zealand).

A general funk clouds the outlook of many Kiwis. A poll of 1,000 eligible voters taken in early October showed that 40% of people think the country is in worse shape since the 2023 election date.

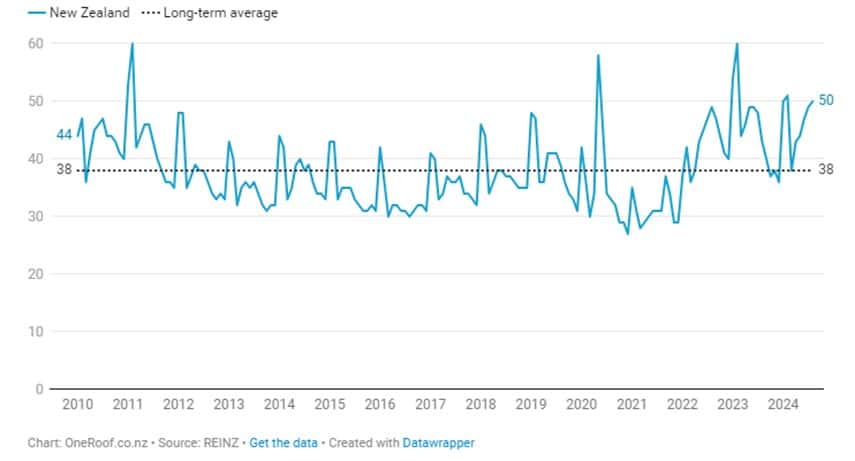

In the meantime, figures from the Real Estate Institute of New Zealand show the median number of days to sell has been tracking upwards since February, hitting 50 in August. These results could even understate the growing lag between listing and sale: around a third of properties listed never sell, so a good number of homes will sit on the market for much longer.

Median days to sell

Will interest rates go lower?

The RBNZ will have an eagle eye on economic numbers, particularly sources of domestic inflation – rates, rents and insurance – which have remained stubbornly high.

However, in a rare piece of positive economic news, for the first time since March 2021, annual inflation is within the Reserve Bank’s target band of 1% to 3%.

However, the central bank will act cautiously to prevent the conditions for exuberant house buying. Geo-political and global economic worries, including the Middle East conflict and China’s economic performance, won’t excite them much.

The mix of conditions suggests a return to gradual cuts – 25 basis points a meeting, or even every other meeting.

Think ‘Goldilocks rate’: one that neither stimulates nor constrains economic activity. The economic consensus seems to place the OCR within a range between 2.75% and 3.5% by early 2026. Bank lending rates usually sit a couple of percentage points above the OCR, so you can forget about the days of pandemic-driven bargain basement rates.

When interest rates fall, buyer enquiries rise. Thinking of selling? Call 0800 GOODWINS for an appraisal.